The Biden administration told you that the record inflation we are seeing is just transitory. Breaking news: It’s not.

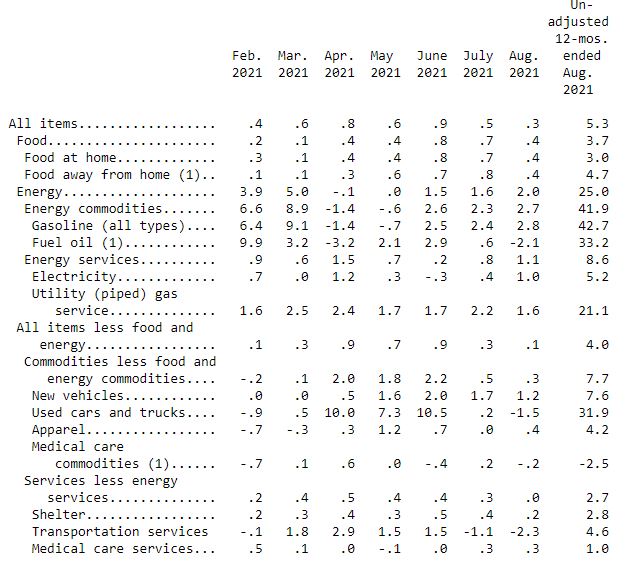

Price increases over last yr (CPI report)… Gasoline: +42.7% Used Cars: +31.9% Gas Utilities: +21% New Cars: +7.6% Overall CPI: +5.3% Electricity: +5.2% Food away from home: +4.7% Transportation: +4.6% Apparel: +4.2% Food at home: +3.0% Shelter: +2.8% Medical care service: +1.0%:

In the U.S., the world’s biggest economy, 8.6% of people said they sometimes or often didn’t have enough to eat during the prior week in a survey completed on Aug. 30.

Whether for bread, rice or tortillas, governments across the world know that rising food costs can come with a political price. The dilemma is whether they can do enough to prevent having to pay it.

Global food prices were up 33% in August from a year earlier with vegetable oil, grains, and meat on the rise, data from the United Nations Food and Agriculture Organization show. And it’s not likely to get better as extreme weather, soaring freight and fertilizer costs, shipping bottlenecks and labor shortages compound the problem. Dwindling foreign currency reserves are also hampering the ability of some nations to import food.

Food is more expensive than almost anytime in the past 60 years. Adjusted for inflation and annualized, costs are already higher now than for almost anytime in the past six decades, according to FAO data.

BRIEFING ROOM

Remarks by President Biden on the Economy

SEPTEMBER 16, 2021

East Room

2:00 P.M. EDT

THE PRESIDENT: Second, we’re not going to raise taxes on anyone making under $400,000.

end quotes

Except inflation is a TAX on those making under $400,000:

REUTERS

“TREASURIES-Treasury yields see-saw as Fed to ‘soon’ reduce bond buying”

By Herbert Lash

SEPTEMBER 22, 2021

The Fed indicated it sees inflation running this year at 4.2%, more than double its target rate.

BRIEFING ROOM

Remarks by President Biden on the Economy

SEPTEMBER 16, 2021

East Room

2:00 P.M. EDT

THE PRESIDENT: According to leading economists — forecasters like Moody’s and major international financial institutions — my plan will create — make us — create jobs, make us more competitive, and grow our economy and lessen — lessen, not increase — inflationary pressure.

I don’t know if it’s been handed out today, but, by the way, 15 Nobel laureates in economics released a letter yesterday arguing that exame [sic] — that exact same point.

They said, and I quote — and this is from 15 Nobel laureates in economics — quote, “Because this agenda…” — the one I’m talking about, mine — “Because this agenda invests in long-term economic capacity and will enhance the ability of more Americans to participate productively in the economy, it will ease long-term inflationary pressures.”

It will ease it.

end quotes

In the meantime, back on the ranch:

CNBC

“Federal Reserve holds interest rates steady, says tapering of bond buying coming ‘soon’”

Jeff Cox

September 22, 2021

Powell said the Fed is getting closer to achieving its goals on “substantial further progress” on inflation and employment.

“For inflation, we appear to have achieved more than significant progress, substantial further progress.”

“That part of the test is achieved in my view and the view of many others,” he said.

There were some substantial changes in the Fed’s economic forecasts, with a decrease in the growth outlook and higher inflation expectations.

The committee now sees GDP rising just 5.9% this year, compared with a 7% forecast in June.

Projections also signaled that FOMC members see inflation stronger than projections in June.

Core inflation is projected to increase 3.7% this year, compared with the 3% forecast the last time members gave their expectations.

Officials then see inflation at 2.3% in 2022, compared with the previous projection of 2.1%, and 2.2% in 2023, one-tenth of a percentage point higher than the June forecast.

Including food and energy, officials expect inflation to run at 4.2% this year, up from 3.4% in June.

end quotes

TEACHER: And hey, kids, what does it mean when we see rising inflation and falling GDP?

LITTLE SUZY: That’s easy!

We learned about that back in pre-K!

It’s called STAGFLATION, which is characterized by slow economic growth and relatively high unemployment — or economic stagnation — which is at the same time accompanied by rising prices, i.e. inflation.

And stagflation can be alternatively defined as a period of inflation combined with a decline in the gross domestic product (GDP).

REUTERS

“Fed signals bond-buying taper coming ‘soon,’ rate hike next year”

By Howard Schneider, Jonnelle Marte

SEPTEMBER 22, 2021

The Fed now projects inflation will run above its target for four consecutive years.

end quotes

But it’s really transitory despite that.

And here is a real HUGE surprise:

CNBC

“Fed Chair Powell to warn Congress that inflation pressures could last longer than expected”

Jeff Cox

September 27, 2021

Federal Reserve Chairman Jerome Powell, in remarks to be delivered Tuesday, cautioned Washington legislators that the causes of the recent rise in inflation may last longer than anticipated.

“Inflation is elevated and will likely remain so in coming months before moderating,” Powell said.

end quotes

But of course, it is transitory, nonetheless.

And if we all recall, the Fed and “TOODLES” Yellen wanted inflation to “run hot,” and so they have got their wish fulfilled.

Buy that loaf of bread now, while you can still afford it, before it becomes another luxury item here in Joe Biden’s America where only the rich and well-to-do like all the millionaires in his administration can afford to live.

CNBC

“Treasury yields rise to start the week, 10-year yield tops 1.5%”

Jesse Pound and Vicky McKeever

September 27, 2021

New York Fed President John Williams told the New York Economic Club on Monday that the U.S. economy is close to the point where the Fed will begin to remove some of its market support.

“I think it’s clear that we have made substantial further progress on achieving our inflation goal.”

Williams said he expected inflation to come back to 2% but it could take a year.

When the federal reserve says inflation is transitory, they really don’t mean transitory, at all.

FED SPEAK, don’t you know:

REUTERS

“Fed’s Evans sees 2.4% inflation in 2024, ‘gentle incline’ in rates”

By Reuters Staff

SEPTEMBER 27, 2021

Sept 27 (Reuters) – Chicago Federal Reserve Bank President Charles Evans on Monday said he expects inflation to rise to 2.4% by 2024 but interest rates to be only on a “gentle incline” upward, a view that contrasts with that of some other policymakers who believe a faster pace of rate hikes will be needed.

“We are trying to solidify strong, firm inflation expectations that allow for 2% over time as an average,” Evans told reporters on the sidelines of the National Association for Business Economics.

In his view, he said, “the brief period of higher inflation… is helpful for reinforcing inflation expectations.”

REUTERS

“Wall Street swoons on rising Treasury yields, growing inflation worries”

By Stephen Culp

SEPTEMBER 28, 2021

Treasury Secretary Janet Yellen said she expected inflation to end 2021 near 4%.

And my goodness, did somebody just say something about STAGFLATION?

REUTERS

“Powell: “Tension” between jobs, inflation is the chief challenge facing Fed”

By Howard Schneider

September 29, 2021

Sept 29 (Reuters) – Resolving “tension” between high inflation and still-elevated unemployment is the most urgent issue facing the Federal Reserve right now, Fed Chair Jerome Powell said Wednesday, acknowledging the central bank’s two goals are in potential conflict.

“This is not the situation that we have faced for a very long time and it is one in which there is a tension between our two objectives…”

“Inflation is high and well above target and yet there appears to be slack in the labor market,” Powell said at a European Central Bank forum, an apparent reference to the 1970s bout of U.S. “stagflation” that combined high unemployment and fast-rising prices.

At the Fed’s most recent meeting policymakers lifted their inflation forecasts for this year to 4.2% – more than twice the targeted level of 2%.

They see that pace easing in 2022 to 2.2%, modestly above where they had pegged it in their previous projections in June.

But asked about his biggest concerns right now, Powell referred to the possible clash between the Fed’s two goals of stable prices and full employment, a situation that could force the Fed to make trade-offs between the two by raising interest rates to tame prices at a time when it still wants to encourage job growth.

“Managing through that over the next couple of years is the highest and most important priority and it is going to be very challenging,” Powell said at a virtual event alongside the heads of the ECB, Bank of Japan and Bank of England.

His comments are among the most direct the Fed chief has made on a topic policymakers have tried to downplay: That current high inflation, if it persists, could force them to begin to tighten monetary policy before they deliver on a promise to reach “maximum employment” and fully heal the job market of its pandemic scars.

And according to those who would know, inflation is not transitory, so buy that loaf of white bread today while you can still afford it:

REUTERS

“Inflation watch: Corporate chiefs see prices moving in only one direction”

By Siddharth Cavale and Anthony Deutsch

October 21, 2021

Oct 21 (Reuters) – For central bankers wrestling with the question of whether inflationary pressures are transitory, industry chiefs around the world have a clear message: prices are only going higher.

Shortages of workers, fuel, cargo ships, semiconductors and building materials as the global economy bounces back after pandemic lockdowns have companies from electric car makers to chocolatiers scrambling to keep a lid on costs.

Some of the world’s biggest brands are now passing on higher prices to consumers and are warning any policymakers sitting on the inflationary fence that things are going to get worse.

“We expect inflation to be higher next year than this year,” said Graeme Pitkethly, finance chief at Unilever, which says its products, from Dove soap to Ben & Jerry’s ice cream to Persil washing powder, are used by 2.5 billion people every day.

Unilever raised prices 4.1% in the third quarter and said they would go up again by at least that in the final three months of 2021, and might accelerate even more next year.

Earlier this week, the world’s biggest food maker, Nestle, said it would increase the prices of its products, which include Nescafe and Purina pet food, further in 2021 and then again in 2022 as raw material costs carry on climbing.