What is it called when institutional traders censor retail investors while getting trading halted so they can receive a cash infusion and have MSM & politicians calling for regulation while smearing Chairman of WallStreetBets?

Now do the 2020 Election.

On the other hand–The masses just learned—virtually overnight—that trading stocks in a coordinated fashion with other amateurs is a far more effective form of protest than marching in the streets.

Noticing the people that loved Big Tech’s power to silence the little guy they disagreed with politically, are now not happy about big tech silencing their bank accounts at the behest of Wall St.

In case you were wondering about all the GameStop short-selling jokes, here it is in a nutshell:

Stocks, when they go up in value, you make money, because it’s worth more than you bought it for. Stock goes up- you make money. Stock goes down- you lose money. Short selling, is the opposite. Short selling makes money when the stock goes down in value.

Waynie borrows Bob’s shares in GME, and sell them for $10, he pays Bob $1 to do this and promises to give all of Bob’s shares back. Then, if the stock goes down to $5, Waynie buys the shares back at a cheaper price, so his profit is $10-$5-$1 = $4 profit.

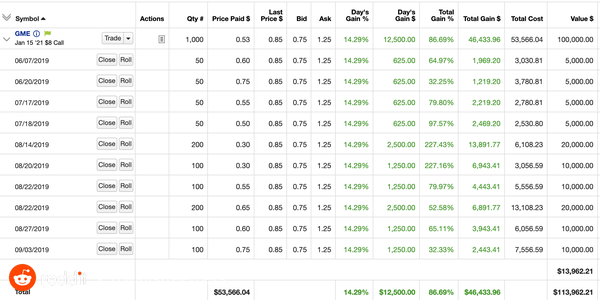

So back in September 2019 (!), some guy named DeepFuckingValue posted this on r/wallstreetbets, “Hey Burry thanks a lot for jacking up my cost basis”:

For the next year, every month about once a month, he posted his “YOLO GME” position. Every month for a year he got made fun of. But, every quarter, public companies are required to release what’s called a “10-Q” which is a quarterly report of their financials. GameStop was actually in a great financial position; they weren’t going broke! In fact, they had a lot of cash-in-hand, enough to pay off all their debts. So why was it trading at like … $2-4/share?

A hedge fund tried to force down the price of Gamestop, and short the stock. It usually works fine. It’s been done thousands of times, with no problems. So they shorted Gamestop (GME) from $20, to $10, to $4. Their greed kept compounding. They kept doing it again, and again, for months. Making billions of dollars, and almost bankrupting this company.

Enter Wallstreetbets- A trading/investing subreddit. Someone noted that these hedgefunds shorted 140% of all shares available. These hedgefunds were so damn greedy, they borrowed more shares than actually existed. That’s how arrogant and dumb they were.

So, the short interest was over 100% of total shares. In fact, it was 140%. Which makes no sense—how can you sell more shares than there are shares? Keep in mind, not all shares are actively traded. In fact, over 75% of $GME is locked up in passive funds and GME board & C-suite.

They borrowed 140% of all the available shares. It was literally impossible for them to buy them all back. So someone on Wallstreetbets realized this and told everyone. Now, the rule with short selling is that ALL those shares that they borrow must be paid back.

So really, short interest was like 300-500% of *float* (float is how many shares are actively traded, basically). Which is insane. Basically, the shorts (which are hedge funds like Melvin) were expecting $GME to go bankrupt and they’d never have to cover (return their shares).

Realizing that these hedgefunds shorted GME by a ridiculous amount, these Redditors (normal people like you and me), bought every share they could get their hands on. Driving the price up like crazy. Because these hedgefunds eventually (within a few months) HAD to buy all those shares back, at whatever price they could get them. They didnt have a choice.

So these Redditors bought the shares, driving the price up, forcing these hedgefunds to buy back at crazy prices. Yeah, the hedgefund sold and made $100 million, but now they had to spend $1.4798 BILLION getting those same shares back.

u/DeepFuckingValue had figured this out long before anyone. Even Michael Burry (yes, The Big Short guy) who bought in AFTER u/DeepFuckingValue. And he bought in, with conviction in his trade, ignoring the haters.

A year later and people start to take notice on reddit. The price has started to inch up, from $4 to $8 to $12 over September and October. And more people on r/WallStreetBets started buying in. And then more people. And then more people.

Eventually, the shorts are supposed to cover. But how? They need to purchase more shares than there are in the company. Well, that means purchasing at any price.

A HUGE LOSS of $1.3798 BILLION.

So eventually, the due date for when these hedge funds need to return the borrowed shares comes closer. And what do they do? They double down. They short MORE. Because they’re sure that they can manipulate the stock enough to get it to crash, thereby saving themselves.

So they start to cover, which means buying hundreds of thousands of shares, which pushes the price up more. And then last Friday, thanks to momentum and growing interest from retail traders, we had what is called a “gamma squeeze.”

So, quick aside to explain this: Market Makers (the big banks and funds, like GS, Citadel, etc) write options. When they do, they have to remain “market neutral” by law. So there are what’s called “the greeks” on options: theta, gamma, etc.

“Gamma” is a number between 0-1 that changes on a call as the price of a stock gets closer to the call price. Lets say you buy a $300 call and the stock is $290. Gamma would be ~0.98. Meaning for every call purchased (which rep. 100 shares), MMs buy 98 shares to be neutral.

As gamma changes, they have to buy more or sell more shares. On Friday, the price was over every available call strike, which meant that MMs had to buy millions of shares—if a call is “in the money” (stock price > call price) they have to deliver the shares.

Eventually Melvin Capital- a multi-billion dollar hedge fund, needs a bailout because it has lost so much money shorting GME. They borrowed billions off another hedge fund. That was Monday. The stock price was $76.

Yesterday the stock ended up at $147.98 for every share. Up from $4. These hedge funds are STILL shorting the stock, at 130% of available shares. That’s how fucking greedy these guys are. All those millions of shares STILL have to be paid back.

So now Hedge funds are crying on literally every platform they can get their hands on. They want the government to stop trading. They want this Reddit forum investigated and banned. They’re screaming ”market manipulation” when in reality these hedge funds were the ones manipulating the stock, but they got caught, and are now trying to take their ball and go home. While these hedge funds are on every news channel screaming about Reddit and Wallstreetbets, they inevitably draw attention to themselves, and what’s going on.

Enter the ”whales”- individual investors who can make a splash and impact the stock. Millionaires and billionaires have a bone to pick with hedge funds and short-sellers. (whether you like these people or not is irrelevant, they’re part of this story regardless).

Elon Musk hates short-sellers because they tried to cripple Tesla so often. With a single tweet, Elon sent the share price skyrocketing from $147.98 to $230. And along with Elon Musk, a huge number of wealthy ”whales” have started to jump in. Buying up HUGE amounts of stock. But these investors don’t care. They don’t care how expensive they buy the stock for. Because they KNOW these hedge funds MUST buy the shares back. For many of them, they don’t actually care if they lose money. They just want to watch these hedge funds burn.

So what happens next? No one actually knows. As time goes on, and as hedge funds fight to buy back as many shares as possible (driving up the prices more on each other), their bill will eventually be due, and they will have to return the borrowed shares.

Brokers took steps to restrict the trading in GameStop stock and options and other related names caught up in a flurry of trading activity that has captivated the attention of Wall Street and caused big losses for hedge funds. In some cases, investors would only we able to sell their positions and not open new ones.

Free-stock trading pioneer Robinhood and Interactive Brokers both made efforts to curb the wild trading activity in heavily shorted names like GameStop, AMC Entertainment, Koss and more on Thursday.

When you short, you pay a borrow fee which can change from day to day. Right now that fee on $GME is between 20-80%. So the longer you’re holding your short position, the more it costs.

Eventually, it either costs too much and you have to close your position for a loss, or you go bankrupt. Melvin almost went bankrupt (until they got a $2.75B bailout from 2 other hedge funds).

So it goes.

This piece should be published in every syndicated paper in the country. It’s that good

Private citizens outsmarted Wall Street and Big Tech. Now they are embarrassed and angry. Too bad. Politicians, big Tech does it all the time. Too bad.

It’s interesting that along with Lizzie Warren, the PEOPLE’S CHAMPION AOC seems to be involving herself in this GameStop caper on the side of $BIG MONEY, as we see in the Yahoo News story “AOC to Ted Cruz: ‘You almost had me murdered 3 weeks ago'” by Christopher Wilson·Senior Writer, on January 28, 2021, to wit:

Rep. Alexandria Ocasio-Cortez said Thursday that she was willing to work with Republicans to investigate the stock trading app Robinhood, but not Sen. Ted Cruz, who she accused of attempted murder for his role in encouraging the Jan. 6 attack on the U.S. Capitol.

On Twitter, Cruz seconded an Ocasio-Cortez tweet about investigating Robinhood’s decision to halt trading on a number of stocks, including GameStop, on Thursday, to which the New York congresswoman responded.

“I am happy to work with Republicans on this issue where there’s common ground, but you almost had me murdered 3 weeks ago so you can sit this one out,” Ocasio-Cortez wrote.

“Happy to work w/almost any other GOP that aren’t trying to get me killed.”

” In the meantime if you want to help, you can resign.”

Calling out Cruz on Twitter on Thursday, Ocasio-Cortez directed at least partial blame for the riot at the junior Republican senator from Texas.

“You haven’t even apologized for the serious physical + mental harm you contributed to from Capitol Police & custodial workers to your own fellow members of Congress.”

“In the meantime, you can get off my timeline & stop clout-chasing,” Ocasio-Cortez added.

Sounds very much like the game is just getting going for anyone who wants to run and get a quick snack:

REUTERS

“Shares rally, retail surge drives silver to 8-year high”

By Herbert Lash

February 1, 2021

NEW YORK (Reuters) – Global shares rebounded from last week’s steep sell-off and silver prices surged on Monday as retail investors expanded their social media-fueled battle with Wall Street to drive the precious metal to an eight-year high.

A shift in the retail trading frenzy to silver drove up mining stocks on both sides of the Atlantic and left precious metals dealers scrambling for bars and coins to meet demand.

The iShares Silver Trust ETF – the largest silver-backed ETF – jumped 7.1%.

Data showed its holdings rose by a record 37 million shares from Thursday to Friday alone, each representing an ounce of silver.

Silver prices climbed to an eight-year peak of just over $30 an ounce before paring gains to trade up 6.3% at $28.70.

The trading frenzy drove huge gains in companies such as GameStop Corp last week, forcing hedge funds to cover bets it would decline.

GameStop slid 30.77% to $225.00.

“Silver has knock-on effects compared to GameStop because it has links to miners,” said Connor Campbell, a financial analyst at SpreadEx.

“If you start pushing silver higher, that is going to have effects on other industries and other markets and that is clearly what happened.”

Silver has gained 19% in price since Thursday after posts on Reddit led small investors to buy silver mining stocks and exchange-traded funds (ETF) backed by physical silver bars, in a GameStop-style squeeze.

Spot silver was up 6.97% to $28.88.

CNBC

“Dow jumps 470 points, posts best day since November as the GameStop trading mania unwinds”

Yun Li @YunLi626 Jesse Pound @jesserpound

Published Tue, Feb 2 2021

U.S. stocks jumped on Tuesday, building on a strong rally in the previous session as concerns about a speculative retail trading frenzy continued to ease.

The back-to-back advance in the broader market coincided with a sharp reversal in GameStop, the video game stock that captivated Wall Street with its massive short squeeze coordinated by a band of retail investors on social media.

GameStop, fresh off a 400% rise last week, fell another 60% Tuesday.

The stock has lost more than 70% of its value since Friday.

“Inevitably, and as with any technically-driven short squeeze, the Reddit rocket ship ran out of fuel and is now crashing back down to earth,” said Max Gokhman, head of asset allocation at Pacific Life Fund Advisors.

“Upon seeing that gravity still works and fundamentals do matter, other market participants are once again comfortable going back into the market and that’s likely been driving this week’s comeback rally.”

Other highly speculative investments popular with the Reddit crowd also plunged.

AMC Entertainment dropped more than 41%.

Futures contracts for silver, which enjoyed their biggest one-day jump in 11 years Monday, slid more than 10% Tuesday for its worst day since August.

Investors took it as a sign that the speculative mania from retail traders is unwinding, which is healthy for the overall market and investor confidence.

The stock market suffered its worst week since October last week as many grew worried that the wild trading activity in those heavily shorted names could be contagious and spill over to other areas of the markets.

Still, some believe that this Reddit-fueled trading mania showed that the collective power of retail investors warrants extra attention.

“Retail investors are a force to be reckoned with,” said Lauren Goodwin, economist and portfolio strategist at New York Life Investments.

CNBC

“S&P 500 ekes out small gain for its third positive day, Alphabet pops”

Yun Li @YunLi626 Maggie Fitzgerald @mkmfitzgerald

Published Wed, Feb 3 2021

After a meteoric, albeit seemingly synthetic rise in GameStop last week caused by a short squeeze, shares have cratered more than 70% this week.

Other Reddit trades have also come back down to Earth amid trading restrictions from major brokers.

CNBC

“Fed’s Mester doesn’t see policy changes coming from GameStop saga”

Jeff Cox @jeff.cox.7528 @JeffCoxCNBCcom

Published Thu, Feb 4 2021

Cleveland Federal Reserve President Loretta Mester said top regulators should be looking at the GameStop trading saga and how it is impacting markets.

“I do think that we need to ensure that it’s a fair marketplace, because as you know financial markets are important for the economy,” she said.

“I’m glad that Janet Yellen is getting all the regulators together to look at what happened.”

Yellen, the new Treasury secretary, has called for a summit of regulatory agencies including the Fed and its New York district, the Securities and Exchange Commission and the Commodity Futures Trading Commission.

The meeting is in response to market tumult that began with traders on Reddit buying up shares of companies — including GameStop — that big Wall Street investors had been betting against.

Those shares have swung wildly since then, and the matter has raised questions about market stability and the possibility that manipulation played a role.

Questions also have been raised about whether easy Fed policy has been creating instability.

The central bank has kept interest rates anchored near zero for nearly a year and is buying at least $120 billion of bonds a month.

That has created a massive influx of liquidity, with money searching for places to go.