CAPE CHARLES, Va. — The Cape Charles Town Council has approved a change to how Transient Occupancy Tax collections are reported and paid, moving the process from a monthly to a quarterly schedule in an effort to reduce administrative burdens for lodging operators and town staff.

The Town of Cape Charles currently levies a Transient Occupancy Tax, or TOT, equal to 4% of gross occupancy revenue. In addition, the town assesses a flat fee of $4 per night for short-term rentals and $1 per room for bed-and-breakfast establishments and hotel rooms.

Under the previous system, lodging operators were required to calculate and report TOT monthly, with payments due to the Treasurer’s Office by the 20th day of the month following the month of occupancy. For example, taxes collected on June occupancies were required to be reported and remitted by July 20. A 5% discount was available for taxes reported and paid on or before the due date.

Town officials said the shift to quarterly reporting is intended to reduce the time and effort required of short-term rental owners, lodging operators and the Treasurer’s Office while maintaining consistent tax collection and compliance.

Quarterly reporting will decrease the frequency of filings without changing the tax rates or fee structure, officials said, and is expected to streamline administrative processes as the town continues to manage growth in short-term rentals and visitor accommodations.

Town staff said additional information on quarterly reporting requirements and deadlines will be provided to lodging operators.

I was asking Raymond Byrd. But he obviously can't answer. And you're only half right.

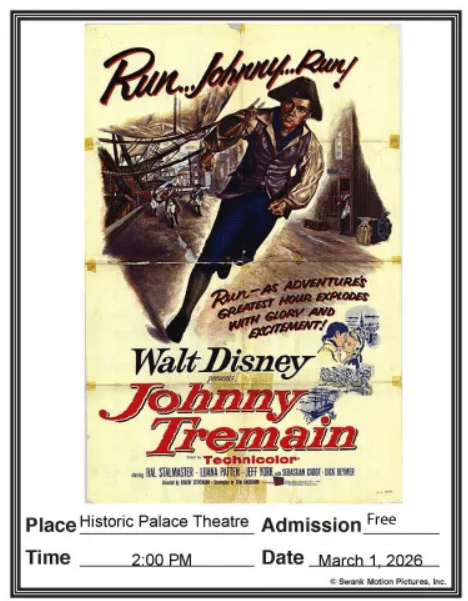

Support the Arts!

I would have to agree with you Elvis.....It's a splendid little hump, and I appreciate a good hump as much…

The only maintenance they ever really did was paint over all the graffiti that was underneath it. That graffiti never…

Anyone that was not born and raised on The Eastern Shore of Virginia.