A good summary of the moment we find ourselves in from Matt Continetti: “A global movement sympathetic to Hamas is fighting an information war with the objective of isolating Israel diplomatically and undermining its right to exist. We have learned that the United States, our universities, and our social media platforms are fronts in this campaign. And we have learned that anti-Semitism has returned with shocking power to demonize, harass, intimidate, and assault Jews throughout the diaspora. What Jewish immigrants to America in the beginning of the 20th century called the ‘Golden Land’ is no exception.”

It is utterly meaningless to tell Israel it “has a right to defend itself” then deny it the weapons to do so, condemn every action it takes, and scream for a ceasefire. The world is making clear that there are no consequences for terrorism. What course is left to us but to reluctantly conclude that the administration’s preferred policy now is that Hamas should win the war it started on October 7?

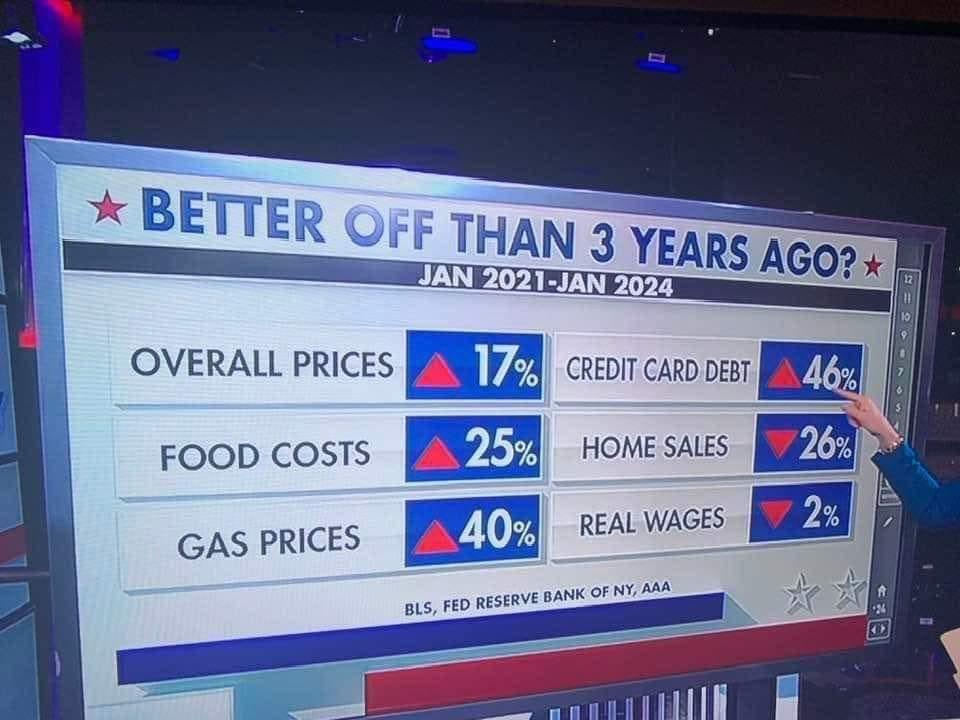

Biden’s Inflation is Strangling America.

The younger generation needs to start understanding that elections have consequences. TRUMP: Mortgage loan 3.72%, Inflation 1.4, % Gas per gal $2.17. BIDEN Mortgage loan 7.5%, Inflation 3.5%, Gas per gal $3.48.

Most people think that an improved and even repaired inflation would restore prices to their 2020 level. That’s not going to happen. Many people are only coming around now to the realization that what happened to us has done permanent damage to purchasing power.

The latest from the official CPI (consumer price index) shows that inflation is going up higher than it did in June 2023. By some measures, inflation is worsening at a faster pace. Anyone who shops for groceries already knows this. Food prices are up 35–50 percent since 2019 and still rising.

Look at prices in general. We are daily slammed with sticker shock. Remember that people do not buy all the products and services in the CPI daily. It has been nothing but bad news every time you take out your wallet.

The job market is still bad. Despite what the experts at the White House try to put out, the jobs data has already experienced a major debunking. Full-time positions are giving way to part-time positions, much of it held by immigrant populations. This is a major factor as to why the establishment and household surveys have diverged so much over the last several years. The job market is not healthy, with a continued lack of labor participation and worsening conditions for professional workers.

From the Wall Street Journal in a separate piece: “the household employment figures haven’t just shown slowing job growth in recent months, but outright deterioration.”

Another corrective comes from the Philadelphia Fed: “In the aggregate, 10,500 net new jobs were added during the period rather than the 1,121,500 jobs estimated by the sum of the states; the U.S. CES estimated net growth of 1,047,000 jobs for the period.”

The interest-based cost of borrowing puts last year’s inflation rate at 18 percent, which is far worse than the 1970s. If we add a correct estimate of health insurance costs, we could be looking at 20-plus percent on an annualized basis.

With the election upcoming, the liberal media and Democrats will continue to work hand in hand to push the propaganda that everything is just fine. But you know it isn’t.

Discover more from CAPE CHARLES MIRROR

Subscribe to get the latest posts sent to your email.

We know it isn’t and we know as well that there is now doodly-squat we can do about.

The pooch has been screwed!

Reuters

“Strong US labor market underpins economy in first quarter”

By Lucia Mutikani

April 5, 2024

The healthcare sector led the broad increase in employment, adding 72,000 jobs that were spread across ambulatory services, hospitals as well as nursing and residential care facilities.

Government payrolls increased by 71,000 jobs, boosted by local and federal government hiring.

The construction sector added 39,000 jobs, about double the average monthly gain of 19,000 over the last 12 months.

Leisure and hospitality payrolls rose 49,000, returning employment to its pre-pandemic level.

There were also increases in employment in the social assistance, retail and wholesale trade sectors.

Financial activities reported modest gains in payrolls as did mining and logging, transportation and warehousing.

Professional and business services employment rose slightly, with temporary help – seen a as harbinger for future hiring – posting a small decline.

But manufacturing added no jobs last month as did the information sector.

Utilities shed 400 jobs.

Wages increased 4.1% on a year-on-year basis, the smallest gain since June 2021, after advancing 4.3% in February.

end quotes

I found it quite interesting that manufacturing added no jobs last month, while government payrolls did.

Before talking about inflation, it’s necessary to define what inflation is. It is NOT the price increases in goods and services. Those are just the symptoms. The term “inflation” means to “inflate the supply of money,” also known as money printing, which these days typically doesn’t even mean actually printing money. Instead, it’s the creation of money digitally, created out of thin air.

Such action by a government is known as an implicit tax. Examples of explicit taxes would be sales taxes, property taxes, income taxes, etc. An implicit tax is one that takes away buying power from you and transfers it to the government. You don’t even realize it’s happening and you blame stores, business owners, or whomever, anyone but the government. By creating more money and circulating it, the government devalues the money you possess and transfers buying power to itself. You have been effectively taxed and you don’t realize it.

It would also be more accurate to say the problem isn’t that the prices of this or that are going up, but the value of your money is being driven down.

Until you can define the problem, you have no hope of determining a solution.

We in here why are not stupid have brought up that exact issue about money devaluation in here before this, many times, as I recall.

I believe I recall Wayne Creed in at least one article making that exact point.

As for me, I have personally quoted from The Library of Economics and Liberty article titled “Democracy in Deficit: The Political Legacy of Lord Keynes” by James M. Buchanan and Richard E. Wagner, on the subject in words very similar to yours above here about the hidden tax, which is the best tax for a government to apply, and how the merchants get blamed, the way American autocrat Joseph Robinette Biden, Junior and his lackeys Lael Brainard and Janet “TOODLES” Yellen are attacking them now, as if they are our defenders and the “good guys,” as opposed to the cause of the problem:

Yet it takes no scientific talent to observe that ours is not an economic paradise.

During the post-Keynesian, post-1960 era, we have labored under continuing and increasing budget deficits, a rapidly growing governmental sector, high unemployment, apparently permanent and perhaps increasing inflation, and accompanying disenchantment with the American sociopolitical order.

This is not as it was supposed to be.

After Walter Heller’s finest hours in 1963, fiscal wisdom was to have finally triumphed over fiscal folly.

The national economy was to have settled down on or near its steady growth potential, onward and upward toward better things, public and private.

The spirit of optimism was indeed contagious, so much so that economic productivity and growth, the announced objectives for the post-Sputnik, post-Eisenhower years, were soon abandoned, to be replaced by the redistributionist zeal of Lyndon Johnson’s “Great Society” and by the no-growth implications of Ralph Nader, the Sierra Club, Common Cause, and Edmund Muskie’s Environmental Protection Agency.

Having mastered the management of the national economy, the policy planners were to have moved on to quality-of-life issues.

The “Great Society” was to become real.

What happened?

Why does Camelot lie in ruin?

Viet Nam and Watergate cannot explain everything forever.

Intellectual error of monumental proportion has been made, and not exclusively by the ordinary politicians.

Error also lies squarely with the economists.

The academic scribbler of the past who must bear substantial responsibility is Lord Keynes himself, whose ideas were uncritically accepted by American establishment economists.

Keynesian economics has turned the politicians loose; it has destroyed the effective constraint on politicians’ ordinary appetites.

Armed with the Keynesian message, politicians can spend and spend without the apparent necessity to tax.

end quotes

So, the federal government has “borrowed” TRILLIONS of dollars through the issuance of debt that was purchased by the federal reserve, which agency printed $TRILLIONS of the electronic funny money you are talking about, and the federal government then flooded the economy with that money to make our money worth less, like money in the Weimar Republic, and guess what, Piglet, we, the American people are totally shut out of the process, because the federal reserve answers to exactly no one on monetary policy, so those of us who do understand the problem are totally powerless to do anything about it.

From “Democracy in Deficit: The Political Legacy of Lord Keynes” by James M. Buchanan and Richard E. Wagner, written in 1998:

But who can deny that inflation, itself one consequence of that conversion, plays some role in reinforcing several of the observed behavior patterns.

Inflation destroys expectations and creates uncertainty; it increases the sense of felt injustice and causes alienation.

It prompts behavioral responses that reflect a generalized shortening of time horizons.

“Enjoy, enjoy” — the imperative of our time — becomes a rational response in a setting where tomorrow remains insecure and where the plans made yesterday seem to have been made in folly.

As we have noted, inflation in itself introduces and/or reinforces an antibusiness or anticapitalist bias in public attitudes, a bias stemming from the misplaced blame for the observed erosion in the purchasing power of money and the accompanying fall in the value of accumulated monetary claims.

This bias may, in its turn, be influential in providing support to political attempts at imposing direct controls, with all the costs that these embody, both in terms of measured economic efficiency and in terms of restrictions on personal liberty.

Even if direct controls are not imposed, however, inflation may lend support for less direct measures that discriminate against the business sector, and notably against private investment.

Central governments possess an alternative to debt as a means of financing budget deficits.

They can create money which may be used directly to cover revenue shortfalls.

In fact, much of what is ordinarily referred to as “public debt” really represents disguised monetary issue by central banks.

How does this institution affect our analysis of budget imbalance?

In the non-Keynesian world, the inflation generated directly by the money created to finance a budget deficit is analytically equivalent to a tax, and many economists have examined it in these terms.

In terms of the fiscal perceptions of citizens, however, inflation does not seem at all equivalent to a tax.

No explicit political discussion and decision takes place on either the source or the rate of tax to be imposed.

Individual citizens are likely to be less informed about the probable costs of an “inflation tax” than they are about even the most indirect and complex explicit levy.

The tax signal under inflation is overwhelmed by the accompanying noise which takes the form of rising prices, at least under prevailing institutional arrangements.

Psychologically, individuals do not sense inflation to be a tax on their money balances; they do not attribute the diminution of their real wealth to the legalized “counterfeiting” activities of government.

Rather, the sense data take the form of rising prices for goods and services purchased in the private sector.

The decline in real wealth is attributed to failings in the market economy, not to governmental money creation.

It is a rare individual (not one in a million, according to Keynes) who is able to cut through the inflation veil and to attribute the price increases to government-induced inflation produced by the monetary financing of budget deficits.

Inflationary finance, then, will generally produce an underestimation of the opportunity cost of public services, in addition to promoting a false attribution in the minds of citizens as to the reason for the decline in their real wealth, a false attribution that nonetheless influences the specific character of public policies.