Funny how things have totally gone south as soon as Trump left. Biden’s standing up to Putin is the same way he stood up to Corn Pop.

Yeah I guess we’re not talking about Covid anymore.

Putin is a patient strategist. His war against Ukraine is eminently rational in view of his prior ideological commitments and the present weakness of his geopolitical rivals. Ukraine is not scary, it should have been obvious to our foreign policy “experts” that Putin would eventually attempt this—and that global pandemic fatigue provided an ideal opportunity.

It’s not really Nato either. Don’t blame the crisis on NATO’s eastward expansion because it’s been too long since the Baltic states (etc.) joined for that to be the proximate cause. This failure of thought is fundamentally American.

It assumes individual leaders and the nations they govern do not have deep memories that shape longterm strategy. Not every nation is as prone to forget its own history as the U.S.

We’re entering a period in which merely tactical thinking is insufficient. This is a longterm crisis that must be resolved with strategic tools, not the least of which are cultural and spiritual.

Our decadent society is no match for what Putin has just ushered in…

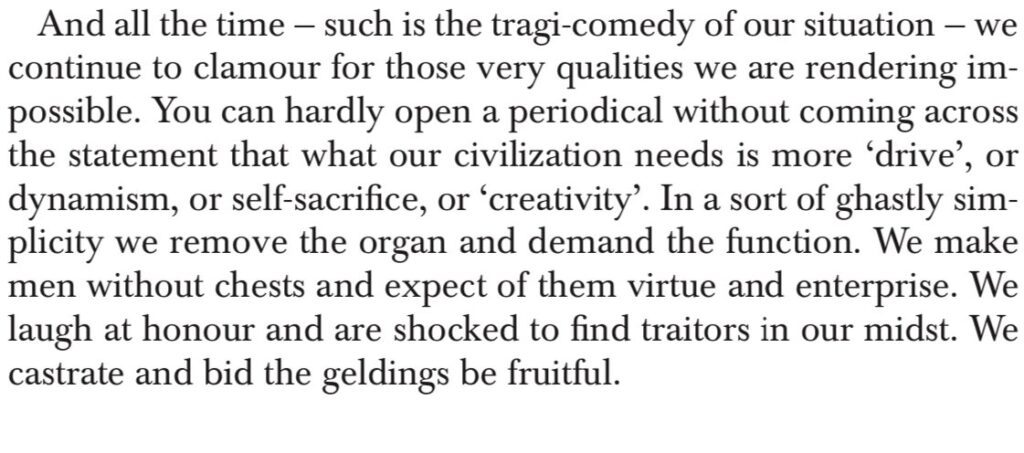

From C.S. Lewis’s “The Abolition of Man”:

Lots-O-Propoganda. What are the chances that the same woman from a bombing in 2018 ends up the exact same way in 2022?

“We must collectively cease the dependence on Russian oil and gas that for too long has given Putin his grip on Western politics” – UK Prime Minister Boris Johnson. Dudes, maybe this wasn’t the best time to shut down the Keystone Pipeline, as well as take the US from net exporter of oil, to a net “consumer” of oil from…the Middle East producers. Ooof.

How you liking the Great Reset so far?

Meanwhile, while you are distracted by the Ukraine theater event….

The myth of Benevolent Authoritarianism is second only to the myth of Honest Big Government in terms of dangerous ideological delusions. Authoritarianism cannot be harnessed to “fortify” democracy, any more than wolves can be taught to guard sheep. The “Great Reset” is supposed to make democracy stronger by making it smaller. High walls of authoritarian power will be constructed around the shrinking meadow of liberty. The walls will be policed by wise, compassionate autocrats and their business partners.

Sure, there is a growing list of things you Little People don’t get to vote on, but don’t worry – those are issues you’re not smart enough to understand. The notion of middle-class boobs or trailer-park rubes daring to defy the Consensus of Experts is absurd. But you see, only by trusting a morally and intellectually superior elite to manage the population and most of our national wealth carefully can we achieve true, meaningful “freedom.” You will be liberated from the burdens of need, consequence, and responsibility. It will never become tyranny. How could it be, when you Little People get to cast a few votes every couple of years? That’s the only check needed on power. You can just “throw the bums out.” It can’t be a dictatorship if people get to vote against the dictator.

“I won 48% of the vote so everyone must do as I command” is NOT AT ALL the same thing as “just government deriving its powers from the consent of the governed,” but too many of us have been tricked into accepting it. Nor would winning 90% of the vote be an acceptable substitute. Whatever happened to the “tyranny of the majority,” the rights of the minority, and keeping politics out of private life? You don’t hear much about any of that stuff anymore, because the Ruling Class is lusting hard after its post-pandemic vision of Benevolent Authoritarianism.

NY Times Opinions, especially Thom Friedman’s, never seem to age well:

CBS–imagine the hubris to run cover for Democrats. Issues plaguing us for a year due to 2 weeks of turmoil in Ukraine!

Trump Inflation: 1.8% Biden Inflation: 7.5% Trump Gas Prices: $1.84 Biden Gas Prices: $3.53

Discover more from CAPE CHARLES MIRROR

Subscribe to get the latest posts sent to your email.

As always, some interesting points are made in here that are thought provoking, especially the one about “(N)ot every nation is as prone to forget its own history as the U.S.”

I would correct that by saying the U.S. is a nation that doesn’t know ANY history, period, about anything!

And I am talking about this incredible pack of morons inside the Washington beltway who think they are the new Rome on the face of the earth with no need to remember history because they are the ones who create the history everybody else will read.

And are they ever doing a bang-up job at that – creating a history of a nation ruled by ******* morons, donkeys and pure goose fools!

And since we are talking history in here, something today only the Cape Charles Mirror seems to know exists or actually cares about out of all the “news” media in America, how about starting with reality, to wit:

THE RUSSIAN-UKRAINIAN FRIENDSHIP TREATY AND THE SEARCH FOR REGIONAL STABILITY IN EASTERN EUROPE

Dale B. Stewart

Captain, United States Army

B.S., United States Military Academy, 1988

Submitted in partial fulfillment of the requirements for the degree of MASTER OF ARTS IN NATIONAL SECURITY AFFAIRS from the NAVAL POSTGRADUATE SCHOOL

December 1997

ABSTRACT

Since the collapse of the Soviet Union in December 1991, world attention has focused on the future of the new independent states (NIS) in Central and Eastern Europe.

Ukraine has been of particular importance because, in becoming an independent state, it has completely changed the geopolitics of Eastern Europe.

Ukraine’s independence pushed Russian borders 500 miles to the east and limited Russia’s access to the Black Sea.

Since 1991, Ukraine and Russia were unable to sign a Friendship Treaty recognizing each others borders.

The signing of this treaty has appeared imminent since 1993, but was always delayed—most recently in October 1996.

A series of contentious issues emerged which cast doubt not only on Ukraine’s stability and future existence, but also on Russia’s.

All the post-Soviet Union arrangements were in question.

After almost six years of negotiations, insult, and conflict, Russian President Boris Yeltsin and Ukrainian President Leonid Kuchma signed the treaty on 31 May 1997.

In the end, it was NATO enlargement that forced Russia to sign the treaty and to recognize Ukraine as an independent state.

This is a study of the difficult process and the issues that arose during negotiations.

end quotes

So there is where it all begins, and none of that history about the break-up of the Soviet Union has ever been a “state secret” known only to a few.

So why don’t we know it today?

THE RUSSIAN-UKRAINIAN FRIENDSHIP TREATY AND THE SEARCH FOR REGIONAL STABILITY IN EASTERN EUROPE

Dale B. Stewart

Captain, United States Army

B.S., United States Military Academy, 1988

Russian national security interests in Ukraine include culture; language; the strong Russian diaspora on the Crimean peninsula, as well as in eastern Ukraine; extensive economic links: defense industry, agriculture, energy, and military early warning radar systems; basing rights at Sevastopol; the Black Sea Fleet; and Ukraine’s strategic and crucial geographic location.

The region is full of precious resources: Donetsk and Kherson coal, Katerynoslav steel, Kharkiv industry, agriculture products (e.g., wheat, salt, tobacco, wine and fruits), and the Crimean peninsula’s vacationing resorts.

Ukraine has similar vital interests in Russia which directly impact on regional stability.

Ukraine depends on Russia for its energy.

The industrial complexes require equipment and parts from Russia.

Many soldiers who declared Ukrainian citizenship and service in the military are Russian.

The country is home to a mix of ethnicities that has made Ukraine’s pursuit for recognized independence difficult.

Russians and Russian speakers largely populate the eastern region of Ukraine, including Crimea.

US engagement in Ukraine has made a significant difference.

Even though the presence and control of nuclear weapons in Ukraine were the causes for initial American involvement, US leaders now realize Ukraine’s significance for stability in the region.

The United States responded to the decline of communism with a “Russia first” policy elaborated in 1992-93.

(“Bubba” Clinton, Hillary’s wayward husband, was president beginning in 1993, having defeated “BIG” Bush in the 1992 election).

This policy essentially disregarded the new East European states’ desires for independence without Russian dominance.

In 1993, the United States took an active involvement in the negotiations for Ukraine’s nuclear disarmament.

Its consistent participation evolved into the US-Russian-Ukrainian Trilateral Agreement in January 1994, which provided Ukraine security assurances in exchange for the dismantling and destruction of all its nuclear weapons.

In 1996, US policy changed to support the development of “geopolitical pluralism” in the region.

President Clinton’s current National Security Policy endorses the spread of democracy and open market reform for fledgling states in the region; this is a total reversal of the US policy of six years ago.

(There we see direct meddling by Washington, D.C. and the Democrats).

Since 1991, Russia and Ukraine have worked on a number of important bilateral issues.

The most significant is a Friendship Treaty resolving differences over borders and trade relations.

The signing of the Friendship Treaty has appeared imminent since 1993, but was always delayed—most recently in October 1996.

The primary stumbling blocks preventing the conclusion of the Friendship Treaty were two: the division of the Black Sea Fleet and the federal status of Sevastopol.

However, these were merely manifestations of a more fundamental problem: Russia did not accept the territorial existence of Ukraine.

We are truly living in a time of madness and insanity!

To destroy Putin, his hated enemy, and make himself the BIG MAN on the world stage, the world leader who is going to build back the world better, this blithering idiot we are saddled with, this Democrat Joe Biden put into office by Nancy Pelosi on 6 January 2022 as a result of an insurrection and coup by the Democrats, is willing to destroy the world, as well:

RIGZONE

“Oil Rose with Increased Russian Sanctions and Possible SPR Release”

by Bloomberg | Julia Fanzeres and Alex Longley

Monday, February 28, 2022

Oil climbed after more sanctions were unleashed to isolate Russia, while the U.S. and its allies consider releasing about 60 million barrels of crude from emergency stockpiles to quell supply fears.

Over the weekend, the U.S. and its allies excluded some Russian lenders from the SWIFT bank messaging system, potentially throwing energy trade into turmoil.

The Russian central bank’s foreign reserves were also targeted.

In a signal about how far governments are willing to go to pressure the Kremlin, BP Plc moved to unload its holding in oil giant Rosneft PJSC by taking a financial hit of as much as $25 billion.

Russia’s invasion of Ukraine has roiled markets from energy to metals and grains, heaping more inflationary pressure on a global economy already grappling with soaring costs.

end quotes

Bottom line, better buy that loaf of bread today while you can still afford, it, assuming you can actually find any to buy on an empty store shelf reminiscent of the Soviet Union back in the 1950’s.

And getting this in ahead of the old senile goofball’s state of the declining union under his incompetent, shallow-thinking, short-sighted administration we have our future unfolding as follows as Joe continues his efforts to totally destroy the world economy so he can build it back better on Marxist principles, we have:

Rigzone

“Oil Flashes Higher on Supply Risks and Underwhelming Strategic Release Plan”

by Bloomberg | Julia Fanzeres

Tuesday, March 01, 2022

Oil surged as a decision by the U.S. and other major economies to release emergency stockpiles failed to ease concerns of a major shortfall in supplies as sanctions mount on Russia.

West Texas Intermediate futures in New York rose 8% to settle above $103 a barrel on Tuesday.

Financial sanctions against Russia continue to mount, raising the specter of a major global supply disruption.

“We are quite afraid that we are going to lose supply from Russia,” said Bart Melek, head of commodity strategy at TD Securities.

The invasion of Ukraine has upended commodity markets from oil to natural gas and wheat, piling inflationary pressure on governments.

While the U.S. and Europe have so far stopped short of imposing sanctions directly on Russian commodities, the trade in those raw materials is seizing up as banks pull financing and shipping costs surge.

Consultant OilX said the probability of heavy disruption of seaborne Russian crude and products is growing, which could push prices above $150 a barrel.

Prices:

West Texas Intermediate for April delivery rose $7.69 to settle at $103.41 a barrel in New York.

Brent for May settlement gained $7 to settle at $104.97 a barrel.

And as our goofy, short-sighted, shallow-thinking, old Joe works to destroy the world economy, by all accounts, this is the one thing in his life, going back to his failed plagiarism attempt, that Joe hasn’t been incompetent at:

Reuters

“Oil surges above $100 a barrel, stocks slide on Ukraine conflict”

By Herbert Lash and Marc Jones

March 1, 2022

NEW YORK/LONDON, March 1 (Reuters) – Oil shot back above $100 a barrel and U.S. and German government debt rallied on Tuesday as fears increased over the impact of aggressive sanctions against Russia after its invasion of Ukraine, further depressing stocks in Europe and on Wall Street.

On the sixth day of Russia’s invasion of Ukraine, the disruption caused by sanctions have raised questions about the toll of the crisis on global growth and inflation.

The upending of Russian trade may spur an increase in the pace of inflation in the short-term for many European jurisdictions, Citi researchers said in a note.

Investors are acting rationally from a market standpoint, driving up oil, gas and commodity prices because they understand there could be supply chain disruptions, said Anthony Saglimbene, global markets strategist at Ameriprise Financial.

“Moving forward, though, there’s all these second- and third-derivative impacts that the market is still trying to figure out,” Saglimbene added.

“When you cut Russia out of the global financial system, what are the ramifications for not only Russia, but stability across Europe right now?”

Russian assets went into freefall with London-listed iShares MSCI Russia ETF plunging 33% to a fresh record low and shares of Sberbank, Russia’s biggest lender, falling to 21 cents on the dollar from just under $9 before the invasion.

Traders in the largest U.S. oil hubs have put imports from Russian companies on hold, even though the White House has said oil sales are not a target of sanctions.

This means sanctions have become more disruptive than expected.

Both oil and gas prices are now up nearly 60% since fears of an invasion of Ukraine began to escalate in November.

This morning, on the NPR news at 6 A.M., I heard the voice of a stark, raving madman coming out of my radio speaker in an incomprehensible torrent of pure rage, and I could well imagine spittle most likely flying from his mouth in all directions and coating his chin and lips as this madman raved about cutting Russia out of the global economy.

The last time I heard a raving madman like this was when I was young and we used to listen to the speeches of Adolph Hitler where Hitler, a rug-chewing madman, would rage and rave in the same fashion!

That’s the first time in my life that I have ever heard a raving madman giving a state of the union address in the United States of America, and in all truth, I hope it is the last.

Back when, when the Democrat moron Baines Johnson was in the white house, his lackey Robert Strange McNamara was asked why we were fighting in Vietnam.

His answer, “to prove that aggression does not pay,” and to prove that point, he and LBJ between them killed off some 58,220 Americans and nearly destroyed out economy while seriously dividing the nation.

Fast forward to this morning where we have this:

Associated Press

“BIDEN VOWS TRIUMPH OVER AGGRESSION”

By Zeke Miller and Colleen Long

2 March 2022

And if Joe Biden has to destroy the world and everything in it to achieve his goal, he is just the madman to do it!

Rigzone

“Oil Soars Past $110 per Barrel”

by Bloomberg | Will Kennedy and Alex Longley

Wednesday, March 02, 2022

Global commodity markets surged to multiyear highs on Wednesday after traders backed away from Russia, sparking anxiety that supply will fall short in everything from wheat to natural gas.

Oil passed $110 a barrel, aluminum hit a fresh record and wheat rose to the highest since 2008.

In Europe, natural gas prices and coal set all-time highs, deepening the region’s energy crisis.

Even though natural resources have avoided direct sanctions, traders, banks and shipowners are increasingly avoiding business with Russia.

They’re concerned about getting embroiled in banking sanctions, worried that new measures will include commodities and fearing the reputational damage of trading with Vladimir Putin’s regime.

The extent of that isolation was revealed as Russia’s Surgutneftegas failed three times to sell any crude oil via its tenders.

“The markets are now adjusting to the next worsening of the crisis,” said Paul Horsnell, head of commodities research at Standard Chartered Plc.

“Things that were unthinkable a week ago are not unthinkable now.”

The commodities chaos caused by Russia’s war in Ukraine will reverberate through the global economy, sparking industry shortages and quickening inflation already at the highest in decades.

Russia is the world’s largest energy exporter, a vital metals supplier and together with Ukraine accounts for 25% of wheat shipments.

The impact of self-sanctioning and rejection of Russian counterparties are multiplying across commodity markets.

European natural gas surged as much as 60%, exceeding this winter’s record as supply fears were compounded by traders trying to avoid exposure to Gazprom PJSC’s trading unit.

Grain traders have been unwilling to take the risk of entering new business or pay the soaring costs of chartering and insuring ships to collect cargo from Russian ports.

Ukraine’s exports are already at a standstill, with growing fears that supply disruptions will spill over into the next season and potentially beyond.

In oil, a large number of tanker owners are refusing to load Russian cargoes until the impact of financial sanctions becomes clearer.

The number of ships booked to load cargoes in March is less than a quarter of the number at the same time last month.

Energy Aspects, a consultant, estimates as much as 70% of Russian exports isn’t currently being traded.

Buyers are increasingly refusing to take Russian crude, forcing sellers to offer record discounts to unload cargoes.

Refiners are meanwhile looking elsewhere for alternative supplies.

The surge past $110 a barrel for Brent crude happened even after the International Energy Agency coordinated the release of 60 million barrels from global stockpiles.

After market close, Brent crude surpassed $115 to touch the highest level since 2008.

“Commodity buyers from energy through base metals to ags are figuring out how they will fill their orders with Russia isolated behind a western-imposed iron curtain,” said Bill Farren-Price, a director at Enverus Intelligence Research.

“Record highs for aluminum and record discounts for Urals all point to a major re-ordering of the global commodities landscape.”

PBS NEWSHOUR

“Putin’s public approval soared as Russia prepared to attack Ukraine.”

Feb 24, 2022 10:17 AM EST

CNN

“Biden enters first State of the Union with second lowest approval on record”

Analysis by Harry Enten, CNN

Updated 12:19 PM ET, Tue March 1, 2022

With his flurry of sanctions against Russia as he tries to destroy that country and its people like Hitler and Napolean tried, this shallow-thinking, short-sighted, ham-handed, ignorant hammerhead Democrat Joe Biden, who was forced on us on 6 January 2022 by Nancy Pelosi and her raving pack of Democrats in the NANCY’S HOUSE, the most expensive and exclusive whorehouse in the galaxy bar none in the successful insurrection and coup against our Constitution, the old goofball has in fact ended up harming us instead of the Russians as we see in the following from the Reuters article “Factbox: Stranded assets: How many billions are stuck in Russia?” on March 3, 2022, to wit:

NEW YORK, March 3 (Reuters) – So far global companies, banks and investors have announced that they have exposure in some form to Russia of more than $110 billion.

That number could rise.

Here is a breakdown of what we know so far as Western sanctions grip Russia’s economy in response to its invasion of Ukraine:

STOCKS AND BONDS – ESTIMATED $60 BLN FROM MUTUAL FUNDS AND ETF

Overseas investors in Russia have tens of billions invested in the country’s stocks and bonds, according to Morningstar data.

U.S. asset managers like Capital Group, Black rock and Vanguard disclosed large exposures, according to the most recent portfolio information available to the research firm.

Disclosures cover a period starting September 2021 through to Feb. 25 this year.

They total over $60 billion when considering the top 100 open-end funds and exchange-traded funds worldwide in terms of estimated U.S. dollar exposure to Russian securities, according to Morningstar data.

Of these, some of the biggest were Capital Group Companies Inc, one of the world’s largest investment management companies, Vanguard and PIMCO and BlackRock.

BANKS – AROUND $78 BLN EXPOSURE DISCLOSED

Bank of International Settlements data show that foreign banks have exposure to the tune of $120 billion to Russia.

The exposure of U.S. banks totals $14.7 billion, according to BIS data.

Of the U.S. banks, Citi announced total exposure of nearly $10 billion.

EXXON MOBIL – $4 BLN EXPOSURE

BP – $25 BLN EXPOSURE

SHELL – $3 BLN EXPOSURE

CALSTRS – $171.5 MLN

The California State Teachers’ Retirement System (CalSTRS), the second-largest U.S. pension fund, said on Wednesday the value of its holding in Russia as of the end of February was $171.5 million.

CALPERS – $900 MLN

CalPERS, which manages the largest U.S. public pension fund, said late on Thursday that the fund had around $900 million of exposure to Russia, but no Russian debt.

How one certifiable raving madman throwing a massive temper tantrum and totally unrestrained by anything can literally overnight destroy the underpinnings of the world economy and send the world into a state of chaos:

Reuters

REUTERS

“Stocks slide as oil surge kindles inflation fears”

By Herbert Lash

March 3, 2022

The price of aluminum, copper and nickel raced to fresh highs as the widening sanctions on Russia for its invasion of Ukraine threatened to further disrupt the flow of commodities from one of the world’s major producers.

The jump in commodity prices has raised concerns about the potential for stagflation — when rising inflation and stagnate output roils the economy and crimps employment.

U.S. stocks initially rose, extending a rally on Wednesday after Powell eased widely held expectations of a 50 basis-point hike in interest rates when policymakers meet in two weeks.

But stocks later fell after Powell told a Senate committee in a second day of testimony before Congress that Russia’s war in Ukraine could hit the U.S. economy from higher prices to dampened spending and investment.

Everything from coal to natural gas and aluminium are surging as Western nations tighten sanctions on Russia following its invasion of Ukraine.

Three-month nickel on the London Metal Exchange (LME) rose to its highest since April 2011, and benchmark LME aluminium rose 5% after hitting a record $3,755 a tonne.

MSCI added to Russia’s financial isolation by deciding to shut the country out of its emerging markets index, while FTSE Russell said Russia would be removed from all its indices.

Biden lickspittle Jennifer Granholm whose head is said to contain so much empty space a 747 could fly around in there for days without fear of running into anything solid, says if we don’t like the high price of gas, we should all run out and buy an electric vehicle, which shows how far out of touch with the reality the majority we all live in she really is:

Rigzone

“Oil Markets Surging on Heels of War Post Record Weekly Gains”

by Bloomberg | Julia Fanzeres and Alex Longley

Friday, March 04, 2022

Oil posted its biggest weekly gain on record with prices swinging in a $20 range since Russia invaded Ukraine and sparked fears of a major supply crunch.

Futures in New York rose by more than $24 this week, the highest weekly dollar increase on record.

Oil extended gains Friday on news the Biden administration is weighing a ban on U.S. imports of Russian crude oil.

JPMorgan Chase & Co. said global benchmark Brent crude could end the year at $185 a barrel if Russian supply continues to be disrupted, and some hedge funds are eyeing $200.

Goldman Sachs says that without Russian barrels on the market, oil could reach $150 in the next three months.

Saudi Arabia raised oil prices for buyers in Asia for April crude at a record price.

West Texas Intermediate for April delivery gained $8.01 to settle at $115.68 a barrel in New York.

Brent for May settlement rose $7.65 to settle at $118.11 a barrel.