Since covid, the car industry is been in a state of crisis. Due to the lack of parts, mainly computer chips, new car inventory has been scarce. This has led to a run on used cars, pushing that market to obscene levels. What nobody has noticed is that the used car market is on the brink of an auto loan collapse.

This is similar to the housing crisis we faced in 2008. When buyers purchase a car, a vast majority (~85%) are financed. Unlike real estate, auto loans are not subject to strict underwriting requirements allowing almost anyone to get one. Just as in 2008, buyers with lower credit scores are given loans with double the interest levels.

From Consumer Reports:

- 25 to 50% of the loans were given to customers who might not be able to repay it

- Lenders only verified the source of income and employment only 4% of the time

5% of Auto Loans are behind payments and nearly half of them are underwater.

Just like how the housing loan crisis in 2008, the same thing is happening in the Auto Loan market.

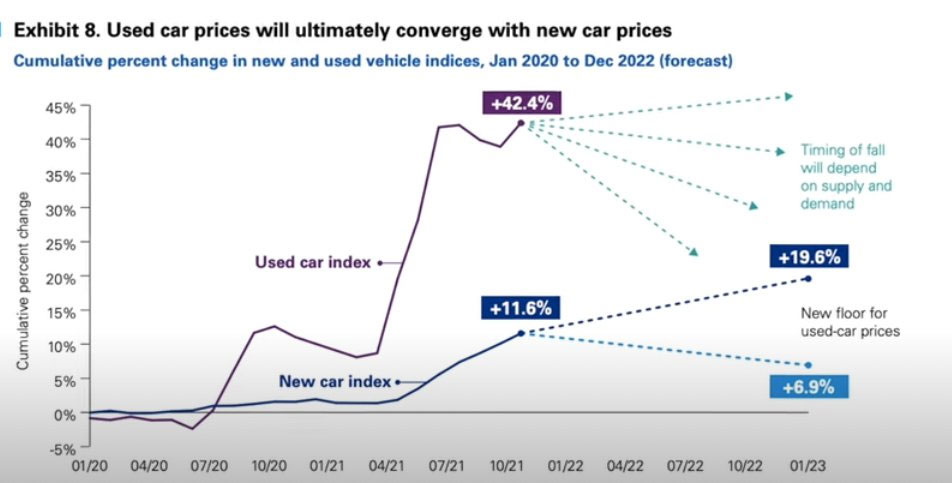

As the new car market has begun to recover, as the supply chain and chip crisis has improved, the effect has been that used car prices have dropped for four consecutive months and are now down 6.4% since January.

For the banks that have lent money to these cars, whose value is rapidly beginning to fall, is not a good scenario.

Equifax reported that 8.5% of subprime borrowers defaulted on their car loans – the second-highest on record.

WSJ also found that more subprime borrowers have started missing out on payments as rising inflation made them choose between essentials (food and gas) and paying auto loans.

Lenders gave buyers unaffordable loans on cars, whose value tanked once the new car crisis started to wane.

KPMG predicts that used car prices can drop 30% as more new car supplies hit the market and Ally Financial predicts a 20% drop.

Some experts feel it is going to unravel in the next 12-18 months.

Just as in 2008, too many people have locked themselves into auto loans that are more expensive than they can afford.

Discover more from CAPE CHARLES MIRROR

Subscribe to get the latest posts sent to your email.

Leave a Reply